Jefferies Surge Bodes Well for Wall Street Heavy Hitters

(Bloomberg) — Jefferies Financial Group Inc.’s revenue jump — due to strong capital markets and rebounding investment banking — bodes well for the bigger banks due to report in weeks to come.

Most Read from Bloomberg

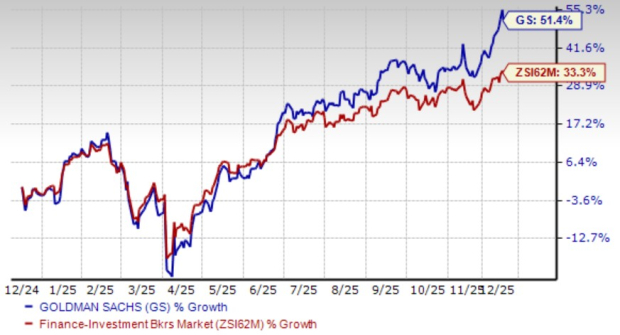

The benchmark KBW Bank Index advanced 0.9% on Thursday, closing at the highest since March 6, 2023, shortly before turmoil struck the industry. The index has yet to fully recover from the epic run on Silicon Valley Bank and the series of lender collapses that hurt the sector last year. The gauge is about 4% below where it was at the start of March 2023, while the S&P 500 has soared 33% during the same period.

Jefferies, with a market value of a little more than $9.3 billion, isn’t part of the index. But its results have long been viewed as an early indicator for other Wall Street banks. Its fiscal quarter ends a month ahead of the calendar quarter.

Although the trading and investment banking revenue that Jefferies touted doesn’t align perfectly with the other banks, executives from rivals including Bank of America have recently said capital markets revenue was trending higher. All of it suggests “healthy trading with fee gains from a weak year-ago,” says Bloomberg Intelligence senior analyst Alison Williams.

Jefferies shares retreated on Thursday, slipping 4.4%. They’d hit the highest close since 2008 on Wednesday, before the late-afternoon earnings were released.

“With the stock near all time highs, investors may have wanted even more,” BI analyst Neil Sipes says.

Bank earnings season kicks off on Friday, April 12, with JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. due to report ahead of the bell. Goldman Sachs Group Inc., Bank of America Corp. and Morgan Stanley come the following week. On March 6, BofA had said its investment-banking unit was on track to report first-quarter revenue growth of as much as 15% from a year earlier.

The long-dormant IPO market is experiencing a watershed moment, as tech companies Reddit Inc. and Astera Labs Inc. went public amid a rush of investor demand that sent their stock prices soaring.

Capital markets activity is among elements investors are likely to focus on during earnings season, according to RBC analyst Gerard Cassidy. He also highlights modest loan growth, deposits shifts and credit trends, particularly for commercial real estate and office properties.

(Adds detail and updates trading in the second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

link